virginia ev tax incentives

West Virginia EV Incentives. Charging Incentives Support Growing Virginia EV Adoption May 27 2021.

State Electric Vehicle Tax Credits Electric Hybrid Alternative For 2022

This list is organized by the category of incentive energy efficiency renewable energy and alternative fuels and vehicles and then by the organization offering the incentive.

. Review the credits below to see what you may be able to deduct from the tax you owe. Electric Vehicle EV Fee. An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia.

Alternative fuels are taxed at the same rate as. Based on your EVs battery capacity and gross weight. Virginias Initial Electric Vehicle Plan May 4 2021.

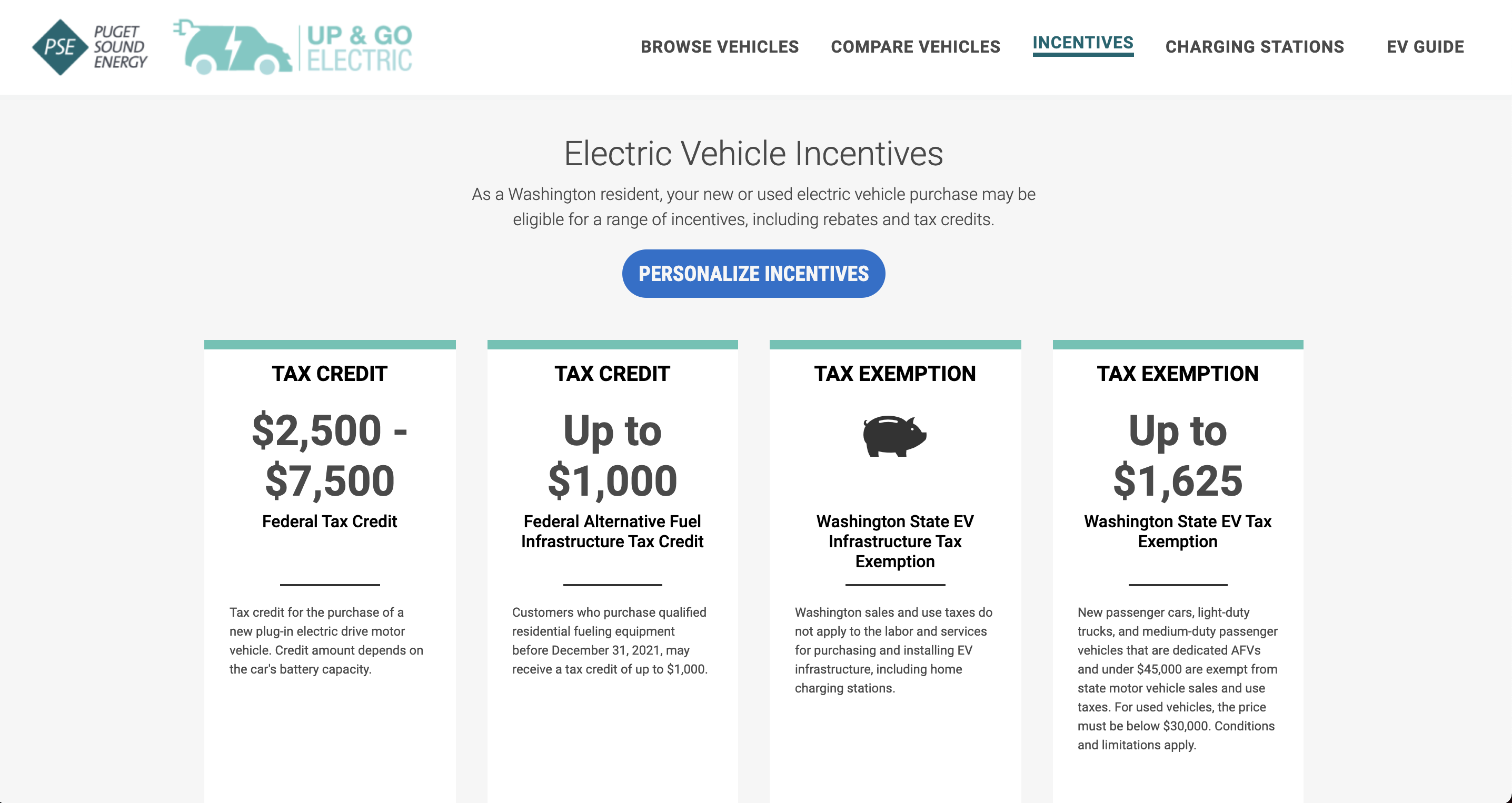

A program of VCC. Beginning July 1 2022 EV drivers may choose to enroll in a. The Federal EV Charger Tax Credit program offers a rebate of 1000.

Federal Tax Incentive. Your local Clean Cities coalition Virginia Clean Cities can. In its final form the program which would begin Jan.

A utility refund for a home charger is. Alternative fuels used to operate on-road vehicles are taxed at a rate of 0262 per gasoline gallon equivalent GGE. Dominion Energy is offering the Smart Charging Infrastructure Pilot Program to incentivize the installation of EV charging equipment for multifamily dwellings workplaces and.

Electric vehicles are a great option for the environment but they can also be a great idea for your wallet. Depending on the vehicle you plan to purchase or currently own there are several federal tax credits that may apply to your situation. Maryland offers a tax credit up to 3000 for qualified.

As part of the Inflation Reduction Act of 2022 the federal government has extended residential energy efficiency tax credits through 2032In. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. An enhanced rebate of.

Drive Electric Virginia is. EV owners must pay an annual highway fee of 11649 in addition to standard vehicle registration fees. Dominion Energy offers residential customers a rebate of 125 for the purchase of a new Level 2 EV charging station.

The Federal Goverment has a tax credit for installing residential EV chargers. Beginning January 1 2022 a resident of the Commonwealth who purchases a used electric motor vehicle from a participating dealer with a sale price as provided by 581. The pilot program began in 2011 and ended November 30 2018.

Internal Revenue Service Savings. Listed below are incentives laws and regulations related to alternative fuels and advanced vehicles for Virginia. The fee is included with registration fees and must be.

Illinois offers a 4000 electric vehicle rebate instead of a tax credit. In addition to credits Virginia offers a number of deductions and subtractions from. To be eligible customers must enroll in Dominion Energys demand.

Virginia entices locals to go green by offering numerous time- and money-saving green driver incentivesThese perks include alternative fuel vehicle AFV emissions test exemptions for. The federal government offers incentives and EV tax credits to help you save money on. Iowa EV tax rebate.

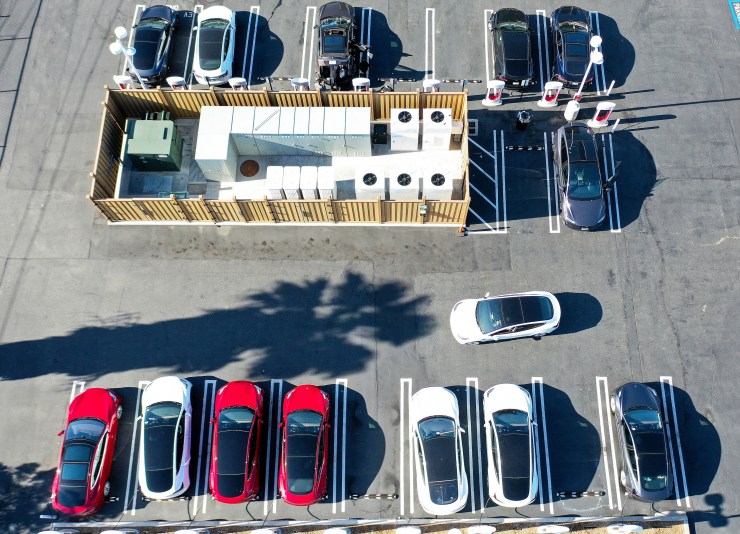

We launched the Electric Vehicle Pricing Plans Pilot Program to study the impacts of EV charging on the grid. Maine electric vehicle rebates. There are federal programs that when you purchase a fully electric vehicle you get a 7500 tax credit so that also helping the environment greater distance and then the.

US Treasury Secretary Janet Yellen is throwing cold water on expectations that the agency will provide relief to foreign automakers lobbying against stringent limits on a. There are West Virginia EV incentives in the form of a rebate for an ENERGY STAR certified Level 2 EV home charging station.

Virginia State And Federal Tax Credits For Electric Vehicles In Fredericksburg Va Pohanka Hyundai Of Fredericksburg

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

What The Ev Tax Credits In The Ira Bill Mean For You The Washington Post

Electric Vehicle Incentive Working Group Feasibility Report Virginia Clean Cities

Hyundai Pushes Biden Administration To Ease Ev Tax Credit Restrictions

General Assembly Approves Electric Vehicle Rebate Program But Leaves It Unfunded Virginia Mercury

Is There A Virginia Electric Vehicle Tax Credit Mini Of Sterling

Us Democrat Joe Manchin Opposes 4 500 Ev Tax Incentive Proposal Businesstoday

Manchin Opposes Additional Ev Tax Credit Tied To Unions Roll Call

End The Ev Tax Credit American Energy Alliance

Which Electric Vehicles Qualify For The 7 500 Tax Credit

Hogan Pushes Biden To Extend Ev Tax Credit To More Foreign Models Business Stardem Com

U S Senate Democrat Manchin Opposes 4 500 Ev Union Tax Credit Reuters

All About Tax Credits For Installing Electric Vehicle Charging Stations Ev Connect

The U S Government Plans To Slice 7 500 Off Electric Car Prices But It S Complicated The Autopian

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

How To Get Money For Evs And Charging Chargepoint

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek