north dakota sales tax nexus

You can lookup North Dakota city and county. If your business has an office or any other place of business in North Dakota temporarily or permanently leasing or renting personal property within the states boundaries any employee agent.

Sales Tax Just Got A Lot More Complicated Are You Ready Teampay Teampay

The businesss primary location online store storefront office etc where it conducts operations is located within North Dakota.

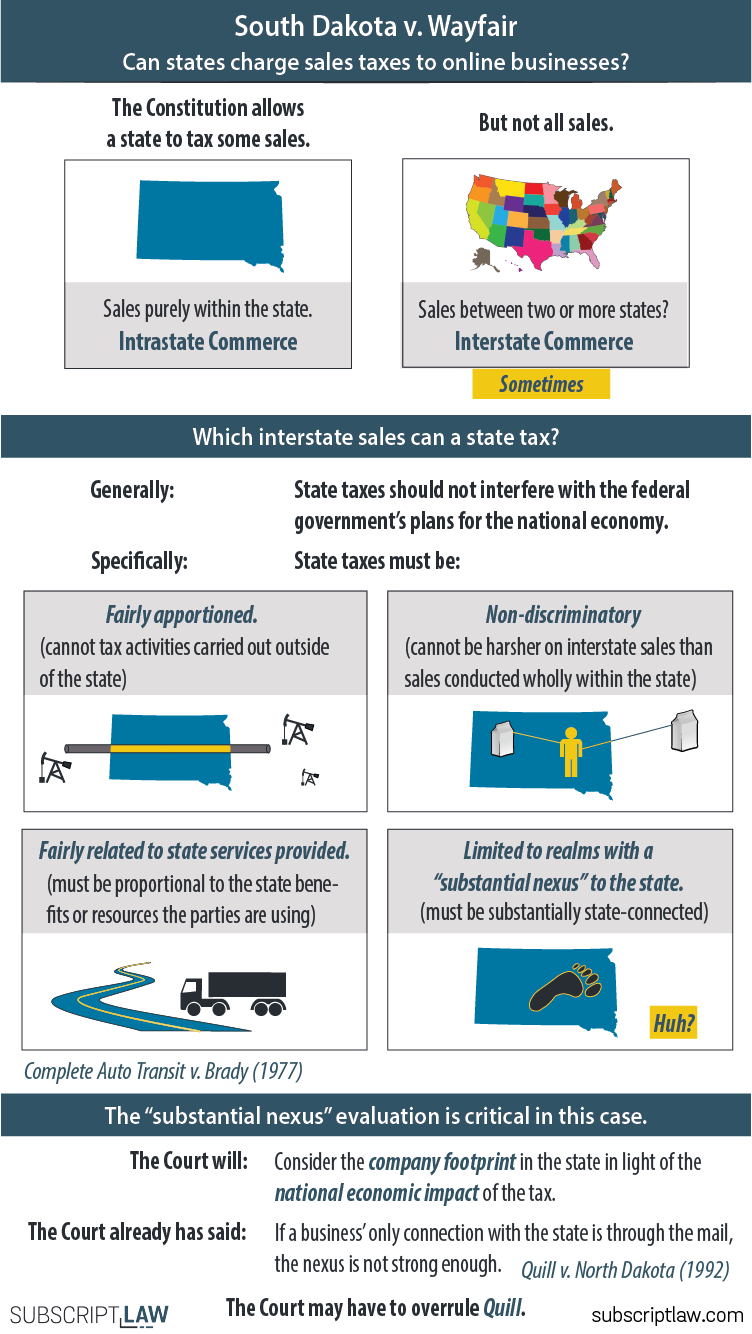

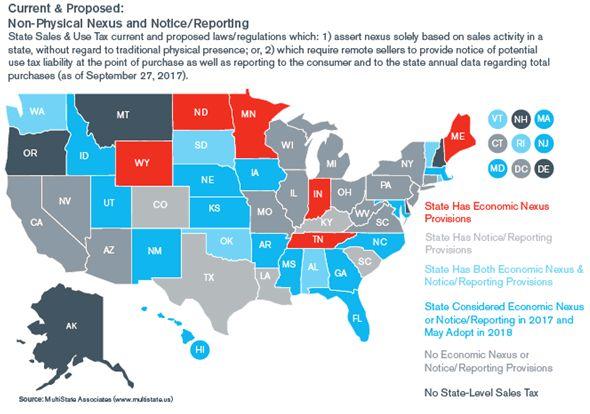

. Wayfair in 2018 Quill Corporation v. At 3 new mobile homes are being built. Supreme Courts decision in South Dakota v.

North Dakota Economic Nexus Explained. Free resource to help you determine how and if you have sales tax nexus and how to set yourself to manage sales tax nexus. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5. The general sales and use tax rate and the motor vehicle excise tax rate was increased from 55 to 6. Use our sales tax calculator or download a free North Dakota sales tax rate table by zip code.

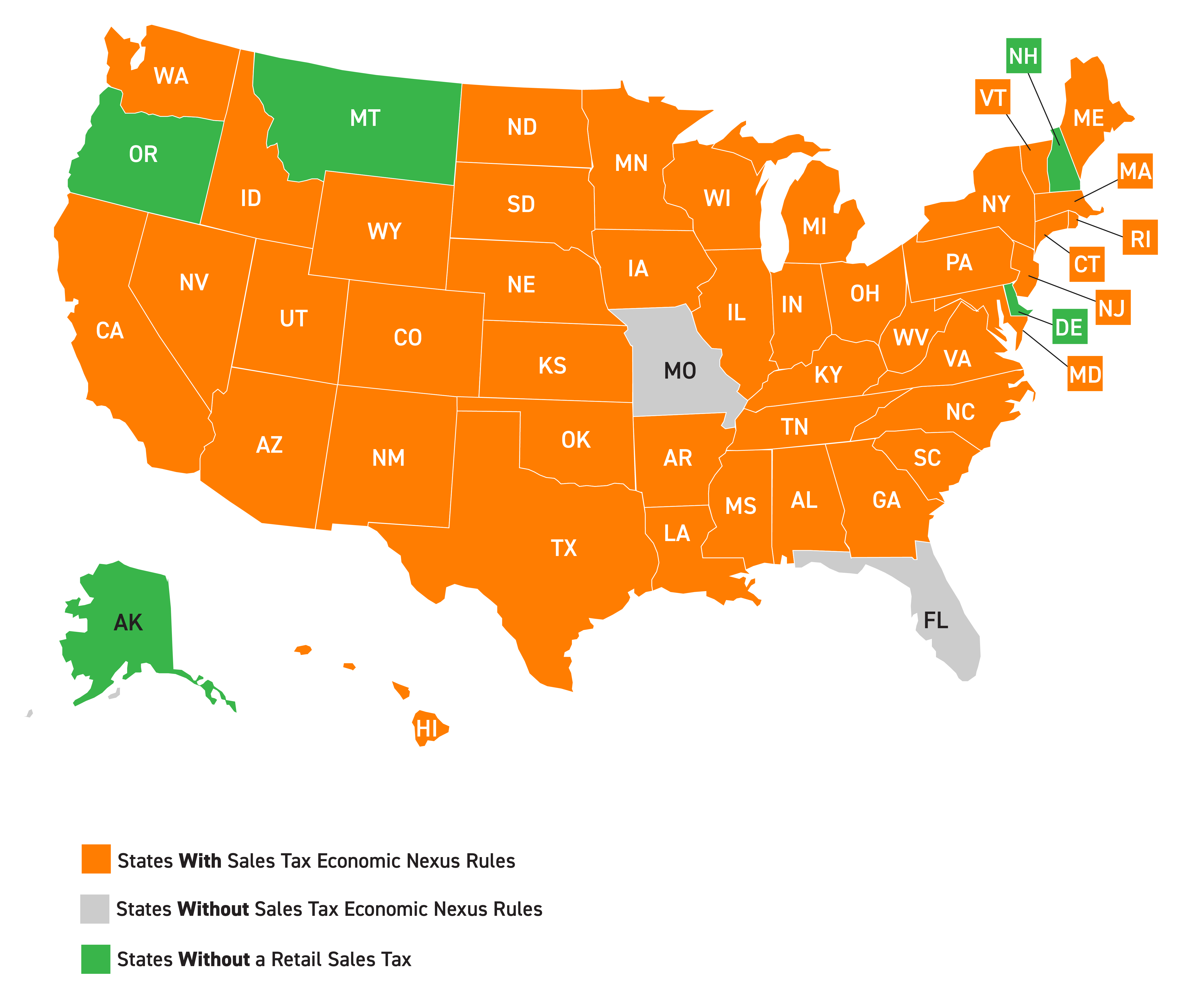

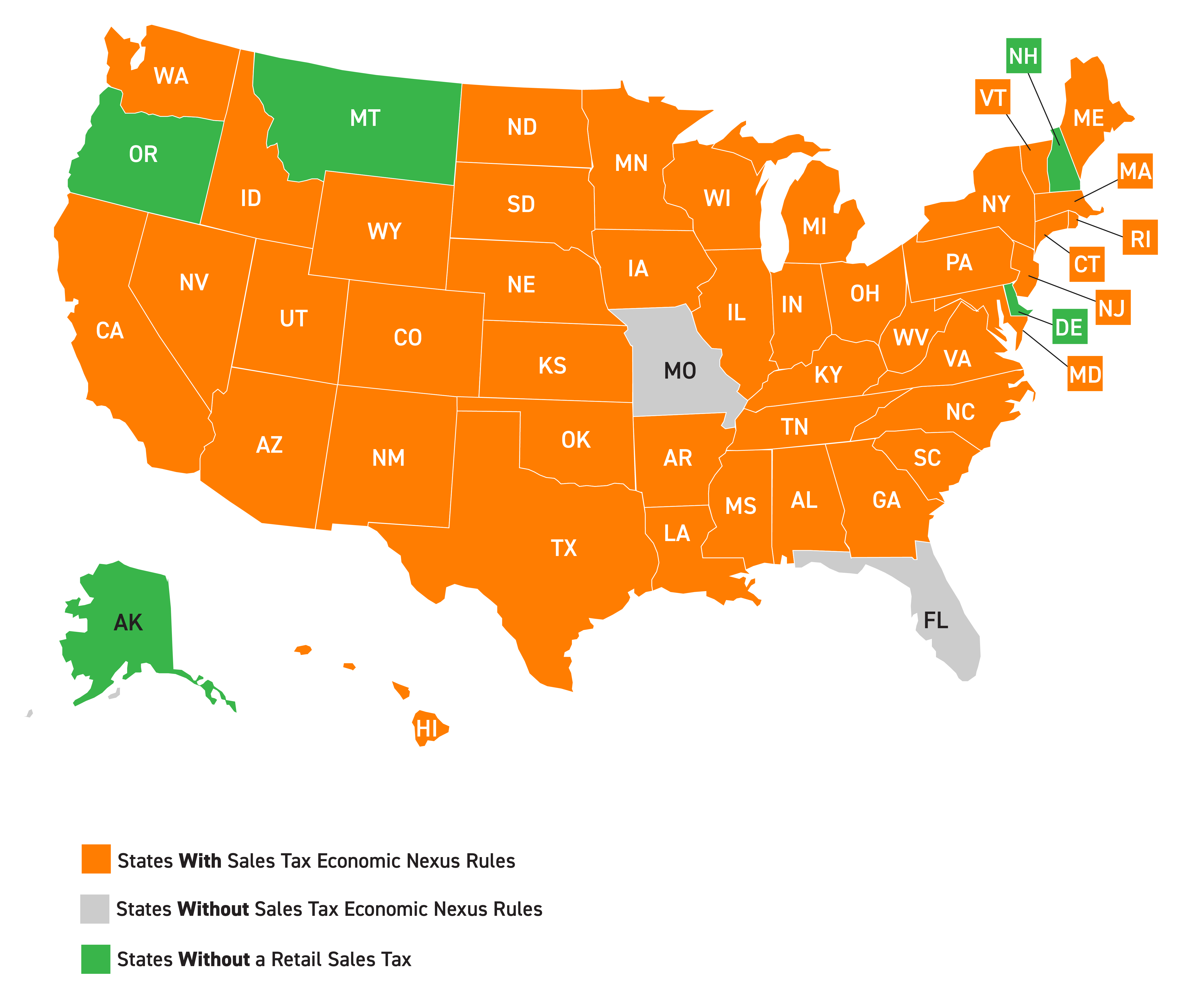

You can read about North Dakotas economic nexus law here. After June 30 2019 those remote sellers may cancel their North Dakota sales and use tax permit and discontinue collecting North Dakota sales tax. 2191 which eliminated the 200 transaction sales tax economic nexus threshold leaving only the 100000 threshold effective for.

North Dakota has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the third quarter of 2021 are up 121 compared to the same. Alcohol content is 7.

One of the foundational court cases regarding sales tax nexus Quill Corporation v. North Dakota sales tax is comprised of 2 parts. A marketplace facilitator without physical nexus in North Dakota that reaches the 100000 threshold for the first time in the current calendar year must register and begin collecting tax within 60 days after reaching the threshold or on January 1 of the following calendar year whichever is earlierTo determine whether the 100000 threshold is met the marketplace.

Nexus has been created based on your volume of sales. Wayfair Inc Et Al the court overturned a previous ruling that required a merchant to have physical nexus in order for a state to collect sales taxThis means that any state is now free to enforce collection of sales taxes on out-of-state online merchants. Customized for You Master Novice Specialist.

The Supreme Court case ruling of South Dakota v. North Dakota took place in North Dakota in 1992. On March 14 2019 the North Dakota Governor signed SB.

This includes North Dakotas state sales tax rate of 50 and Ward countys sales tax rate of 05. Effective October 1 2019 North Dakota has enacted marketplace nexus provisions. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 35.

Read North Dakotas full notice here. Ohio considers a seller to have sales tax nexus if. 2018 Supreme Court Ruling Regarding Online Sales Taxes.

52 rows North Dakota Economic Nexus Ohio. If you meet this threshold it does not matter if you have a physical presence in North Dakota. This physical presence or nexus creates a sales tax obligation for Amazon and many sellers participating in Amazons Seller Central and Fulfillment.

North Dakota also imposes sales tax at a rate of 7. New farm machinery used exclusively for agriculture production at 3. You can find guidance on economic nexus from the North Dakota State Tax Commissioner here.

There are additional levels of sales tax at local jurisdictions too. The gross receipts tax applies to items including. Sales Tax Nexus in North Dakota.

The sales tax is paid by the purchaser and collected by the seller. Out of state sales tax nexus in North Dakota can be triggered in a number of ways. The maximum local tax rate allowed by North Dakota law is 3.

Gross receipts tax is applied to sales of. The state-wide sales tax in North Dakota is 5. The use of new farm machinery in agriculture accounts for 3 of all new equipment.

Charge the tax rate of the buyers address as thats the destination of your product or service. North Dakota saying that a retailer must have a presence in a state before that state can require the seller to collect. By Tom WeissFebruary 18 2020.

The sales tax is paid by the purchaser and collected by the seller. Wayfair enabled states to start collecting sales tax from businesses who now qualify for significant presence in their state. Mary owns and manages a bookstore in Minot North Dakota.

Here youll find information about taxes in North Dakota be able to learn more about your individual or business tax obligations and explore history and data related to taxes. The former Nexus rule was defined through a physical presence in a state which meant that you. That means the effective rate across the state can vary substantially with the combined state and local rate in some places reaching 85.

NORTH DAKOTA SALES TAX NEXUS. In North Dakota there are two types of sales tax. According to the law of North Dakota all retailers who have tax nexus can be defined in several different ways.

Up to date 2021 North Dakota sales tax rates. In the 2018 Supreme Court case South Dakota vs. This means the state considers these vendors obligated to collect sales tax from buyers in the state.

And the rate on alcoholic beverages was increased from 65 to 7. Up to date 2021 North Dakota sales tax rates. Currently combined sales tax rates in North Dakota range from 5 to 8.

State Sales Tax- For most retail sales in North Dakota the sales tax rate is 5. If you had 100000 or more in taxable sales in North Dakota in the previous or current calendar year then you are required to register for collect and pay sales tax to the state. Understand how your online business can be exposed to tax risk.

The rate on farm machinery irrigation equipment farm machinery repair parts and new mobile homes was increased from 35 to 4. Since books are taxable in the state of North Dakota Mary charges her customers a flat-rate sales tax of 55 on all sales. Marketplace facilitators without a physical presence in North Dakota are considered retailers subject to North Dakota sales and use tax if they facilitate sales of property or services that are subject to North Dakota sales tax and meet the states economic.

North Dakota was the law of the land for sales tax nexus. Generally a business has nexus in North Dakota when it has a physical presence there such as a retail store warehouse inventory or the regular. Heres an example of what this scenario looks like.

You will have to comply with the state of North Dakotas individual sales tax laws and apply for a sales tax permit if. Skip to main content. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0959 for a total of 5959 when combined with the state sales tax.

The state sales tax rate for most purchases of tangible personal property in North Dakota is 5 and local governments can impose their own taxes as well.

North Dakota Sales Tax Quick Reference Guide Avalara

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

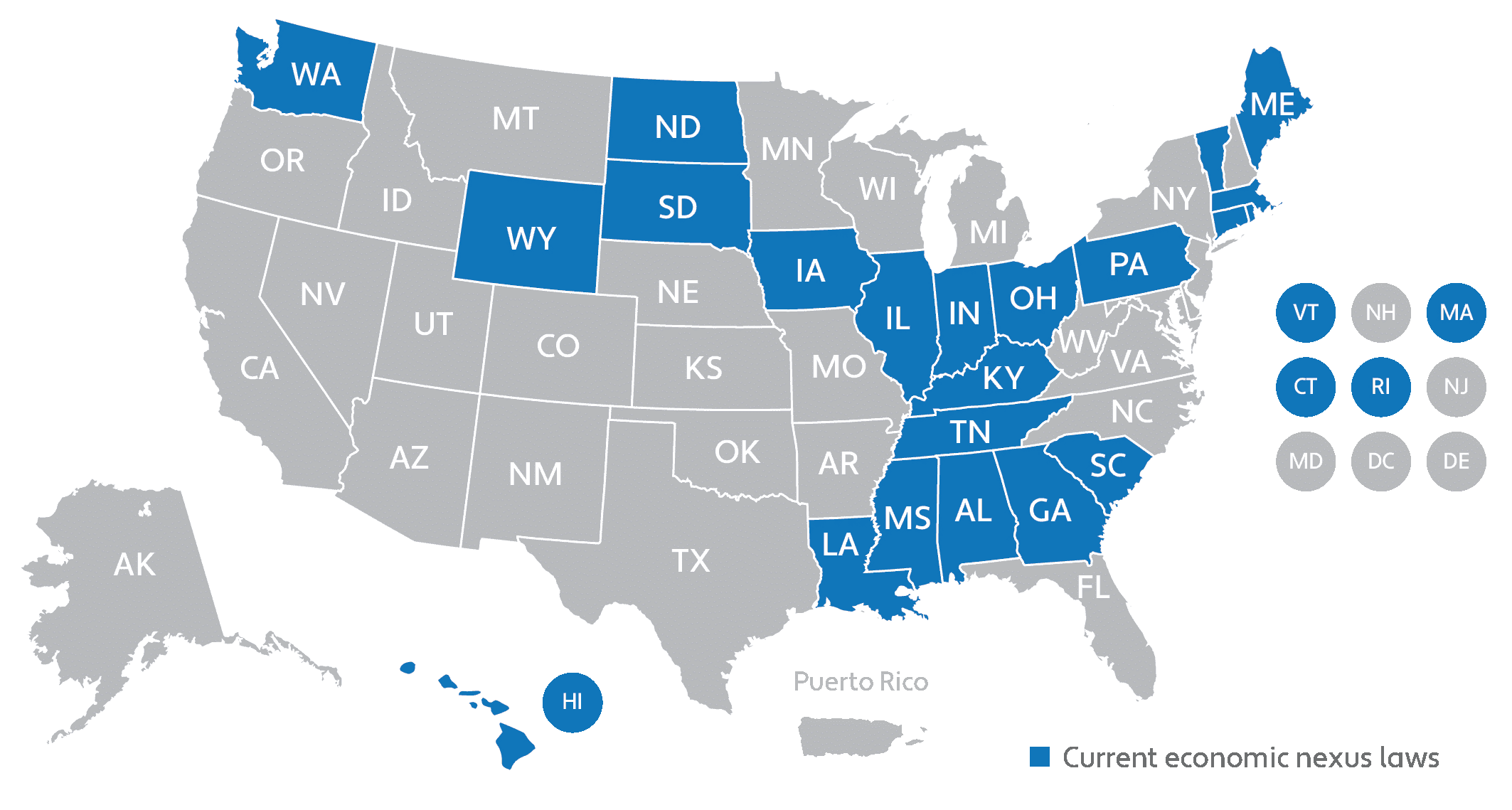

Economic Nexus Laws By State Taxconnex

South Dakota Defeats North Dakota Ends Physical Presence Sales Tax Nexus Debate Carter Shelton Jones Plc

North Dakota Sales Tax Small Business Guide Truic

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Current Trends In Income Tax And Sales Tax Nexus Corvee

North Dakota Sales Tax Handbook 2022

South Dakota V Wayfair How A Supreme Court Case Is Revealing A 26 Year Old Congressional Dormancy Regarding Interstate Online Sales Tax Roosevelt Institute Cornell University

How To File And Pay Sales Tax In North Dakota Taxvalet

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

Redefining Online Sales Tax South Dakota Vs Wayfair And New Tax Compliance

How To Register For A Sales Tax Permit In North Dakota Taxvalet

Business Guide To Sales Tax In North Dakota

Sales Tax By State Is Saas Taxable Taxjar

North Dakota Sales Tax Guide And Calculator 2022 Taxjar